Difference between revisions of "Template:Article of the month"

Shawndouglas (talk | contribs) (Updated for June) |

Shawndouglas (talk | contribs) (Updated for July) |

||

| Line 1: | Line 1: | ||

<div style="float: left; margin: 0.5em 0.9em 0.4em 0em;">[[File: | <div style="float: left; margin: 0.5em 0.9em 0.4em 0em;">[[File:Tab2 Owens-Ott JCannRes20 2.png|240px]]</div> | ||

'''"[[Journal: | '''"[[Journal:Accounting and the US cannabis industry: Federal financial regulations and the perspectives of certified public accountants and cannabis businesses owners|Accounting and the US cannabis industry: Federal financial regulations and the perspectives of certified public accountants and cannabis businesses owners]]"''' | ||

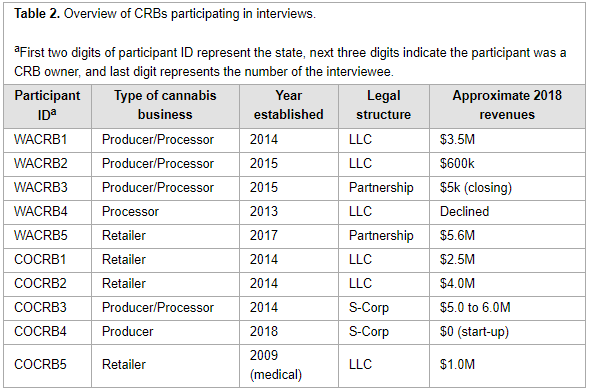

[[Cannabis]]-related businesses (CRBs), in states where cannabis is legal, may be unable to obtain professional financial services such as banking, insurance, and accounting because of federal laws and regulations. This qualitative study investigated the following research questions: 1. Why are some certified public accountants (CPAs) unwilling to provide services to cannabis-related businesses? 2. How do CRBs compensate for lack of CPA services? 3. What does a CPA need to know about the cannabis industry prior to engaging to provide services to CRBs? Data for this grounded-theory qualitative study was gathered from twenty-three semi-structured phone and face-to-face interviews. Ten cannabis-related business owners were recruited from a convenience sample after attempting a broad recruiting effort. Thirteen CPAs with active licenses in Colorado or Washington State participated from firms of varying size and willingness to serve the cannabis industry. ('''[[Journal:Accounting and the US cannabis industry: Federal financial regulations and the perspectives of certified public accountants and cannabis businesses owners|Full article...]]''')<br /> | |||

<br /> | <br /> | ||

''Recently featured'': | ''Recently featured'': | ||

: ▪ [[Journal:Development of a gas-chromatographic method for simultaneous determination of cannabinoids and terpenes in hemp|Development of a gas-chromatographic method for simultaneous determination of cannabinoids and terpenes in hemp]] | |||

: ▪ [[Journal:Cannabinoid, terpene, and heavy metal analysis of 29 over-the-counter commercial veterinary hemp supplements|Cannabinoid, terpene, and heavy metal analysis of 29 over-the-counter commercial veterinary hemp supplements]] | : ▪ [[Journal:Cannabinoid, terpene, and heavy metal analysis of 29 over-the-counter commercial veterinary hemp supplements|Cannabinoid, terpene, and heavy metal analysis of 29 over-the-counter commercial veterinary hemp supplements]] | ||

: ▪ [[Journal:Methods for quantification of cannabinoids: A narrative review|Methods for quantification of cannabinoids: A narrative review]] | : ▪ [[Journal:Methods for quantification of cannabinoids: A narrative review|Methods for quantification of cannabinoids: A narrative review]] | ||

Revision as of 14:08, 5 July 2021

Cannabis-related businesses (CRBs), in states where cannabis is legal, may be unable to obtain professional financial services such as banking, insurance, and accounting because of federal laws and regulations. This qualitative study investigated the following research questions: 1. Why are some certified public accountants (CPAs) unwilling to provide services to cannabis-related businesses? 2. How do CRBs compensate for lack of CPA services? 3. What does a CPA need to know about the cannabis industry prior to engaging to provide services to CRBs? Data for this grounded-theory qualitative study was gathered from twenty-three semi-structured phone and face-to-face interviews. Ten cannabis-related business owners were recruited from a convenience sample after attempting a broad recruiting effort. Thirteen CPAs with active licenses in Colorado or Washington State participated from firms of varying size and willingness to serve the cannabis industry. (Full article...)

Recently featured: